Compliance and Corporate Ethics

Policy and Approach

From the viewpoint of securing the trust of financial markets and individual investors, financial institution business operators are required to have a management attitude that emphasizes compliance. MHR and MIM recognize that failure to ensure compliance is as an extremely serious risk factor and could diminish our public confidence and business base.

By firmly acknowledging this fact, MHR and MIM strictly adhere to various laws and regulations in order to fulfill our public obligations and to faithfully and fairly engage in corporate activities as a basic principle of management. MHR and MIM strive for thorough compliance, holding a high ethical sense in our operations.

Status and efforts for compliance with laws and regulations

The team at MIM, with the board of directors at the top, along with the President & CEO, the Compliance Department, the Compliance Officer and the Compliance Committee determine and verify various matters concerning compliance in accordance with their respective authorities and responsibilities.

MIM has established a "Compliance Manual" which states the compliance-related principles, as well as internal regulations to control major risks related to compliance such as prevention of transactions involving conflicts of interest and blocking of relations with anti-social forces. MIM strives to prevent problems by maintaining and thoroughly informing all executives and employees through periodic training etc. In addition, MIM introduced monitoring and consultation systems such as internal audit and internal reporting procedures to find and correct problems proactively.

The status of these efforts is reported to the board of directors and utilized for periodic risk assessment.

Initiatives Against Transactions Involving Conflicts of Interest

MIM shall perform its business in good faith and with the due care of a prudent manager for MHR in line with the purpose of the investment management business, and is well aware that failure to ensure thorough compliance, especially inappropriate transactions or transactions involving conflicts of interest with the sponsor company group, may undermine investors’ trust in the securities markets, the corporate management base of MHR and MIM.

Therefore, MIM will use its efforts to prevent any negative impact from transactions involving conflicts of interest and carry out strict compliance as follows.

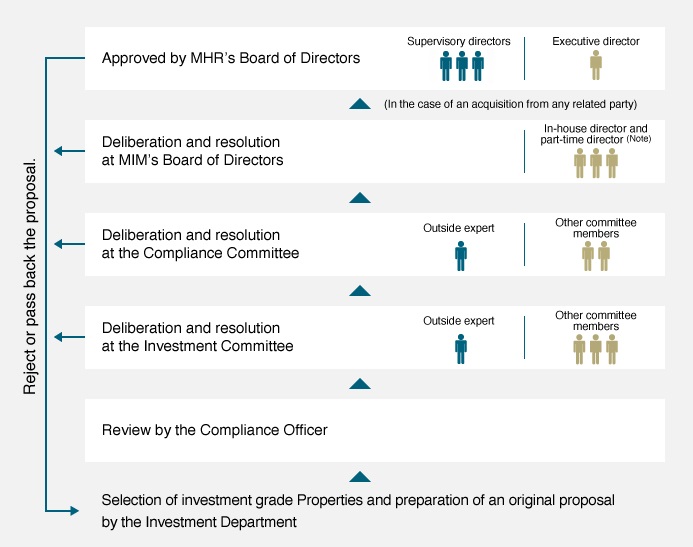

Process to Counter Transactions Involving Conflicts of Interest

- (Note)

- When acquiring assets from a related party, if a director is an executive or employee of MHR's parent company or the related party (including concurrent positions, but excluding cases where they are seconded or transferred to MHR), such director is not permitted to participate in the relevant resolution of the Board of Directors.

Blocking relations with Anti-Social Forces

MIM provides a statement on “severing all ties, including business ties, with anti-social forces” in its “basic rules on response to anti-social forces.”

Accordingly, MIM endeavors to develop an internal structure, such as assigning a person responsible for overseeing and managing responses to anti-social forces and a person responsible for preventing unjust demands, and also periodically ensuring that all officers and employees are thoroughly informed of how to respond to anti-social forces, etc. through in-house training, etc.

Preventing Fraud and Corruption

MIM has formulated a "Compliance Manual" that sets forth the corporate ethics standards such as principles of compliance-related behavior, strict compliance with various laws and regulations including banning bribery, banning insider trading, prohibiting acts that may cause conflicts of interests such as corporate entertainment, gifts and acceptance of benefits that gives rise to public suspicion or distrust.

When a compliance violation or fact of doubt of such is recognized, it is prescribed to report that matter immediately to the Compliance Officer, and when the compliance officer deems it necessary in compliance with law regulations, and other rules, the matter will be reported to the president of MIM and the compliance committee for execution of appropriate measures.

With regard to these prohibited acts, under the system with the president of the asset manager being the person ultimately responsible for compliance and the Compliance Officer being the person responsible for overseeing compliance, we regularly conduct sessions on prevention of fraud and corruption and other corporate ethics standards to familiarize all employees including contract employees and part-timers with these issues and have established a monitoring and consultation system incorporating an internal auditing and whistleblowing system which is official and anonymous and allow whistleblower to report directly to external attorneys for prevention of problems as well as early detection and correction.

|

FY 2020

|

FY 2021

|

FY 2022

|

FY 2023

|

FY 2024 |

| No. of compliance sessions held |

3 |

4 |

4 |

4 |

4 |

Total amount of political donations [yen]

|

0 |

0 |

0 |

0 |

0 |

No. of cases of exposure related to fraud and corruption

|

0 |

0 |

0 |

0 |

0 |

No. of cases of punishment/dismissal related to fraud and

corruption

|

0 |

0 |

0 |

0 |

0 |

Reconciliation cost of penalties/punishment related to fraud

and corruption [yen]

|

0 |

0 |

0 |

0 |

0 |

Whistleblower System

We have established a Whistleblower Protection System which is official and anonymous and allows all officers and employees of MIM (including contract employees, part-timers, retired employees, etc.) and all employees of its business partners (including contract employees, part-timers, retired employees, etc.) to report directly to external attorneys regarding acts that violate laws, internal rules, action principles and other acts that may be contrary to corporate ethics etc.

We strive to thoroughly inform all officers and employees to prevent, to detect and to correct problems at an early stage.

In the event of whistleblowing, the Investigation Committee with members appointed by external lawyers will conduct necessary investigations and countermeasures in accordance with MIM’s "Whistleblower Protection Regulations" by considering the confidentiality of the whistleblower and the privacy of the concerned parties.

Whistleblowers are provided legal protection under the Whistleblower Protection Act, and we prohibit retaliatory actions such as detrimental treatment and harassment due to whistleblowing and take appropriate measures to protect whistleblowers and to make "Whistleblower Protection Regulations" works properly.

Appropriate measures will be taken so that the work environment will not deteriorate after whistleblowing.

| (Number of reports and outline of corrective measures) |

FY 2020

|

FY 2021

|

FY 2022

|

FY 2023

|

FY 2024 |

| 0 |

0 |

0 |

0 |

0 |