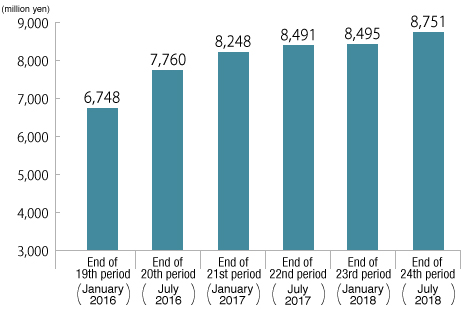

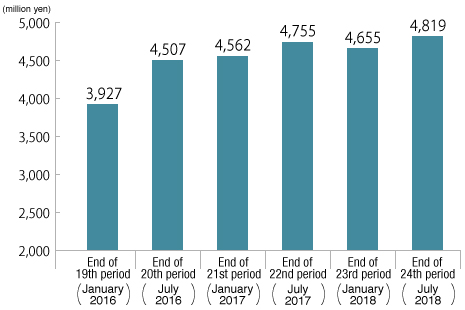

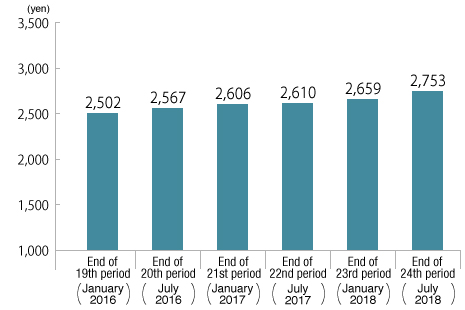

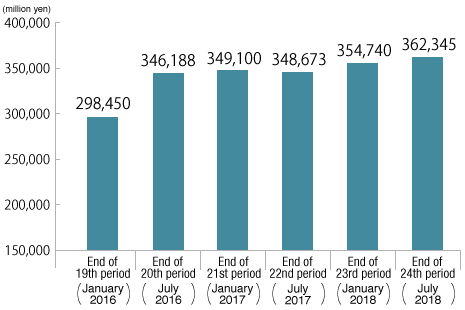

Financial Highlights

Operating Results

19th fiscal period (January 2016)-24th fiscal period (July 2018)

Operating revenues

※As the accounting policy was changed in the twenty-first fiscal period, the figures for the twentieth fiscal period are figures

after retrospective application. The same applies hereafter.

Net income

Dividend per unit

※A 5-for 1 split of investment units was implemented on February 1, 2014.

Total assets

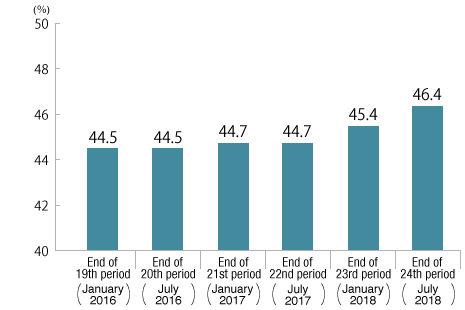

LTV (book value basis)

Change in Financial Highlights (Excel:30KB)

- (Note 1)

- Net income per unit for the periods with capital increase are calculated based on the average number of investment units during the period.

- (Note 2)

- As the accounting policy was changed in the twenty-first fiscal period, the figures for the twentieth fiscal period are figures after retrospective application.

Diversification of borrowing maturities

Diversification of borrowing maturities